TAX CUTS 2005 - 2007

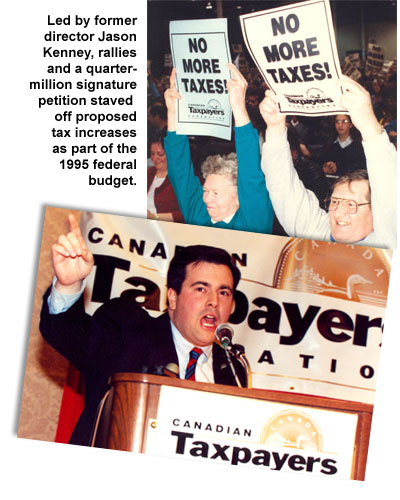

It seems that tax cuts hit the radar screen every five years. The CTF organized cross-country rallies opposing proposed new taxes in 1995, successfully fought to eliminate bracket creep and reduce income tax rates in 2000 and in 2005 played a leading national role in bringing taxes down yet again.

After years of demanding excessive federal surpluses be returned to taxpayers, on the eve of an election call in November 2005, the Liberal government announced an immediate and retroactive reduction of the bottom income tax rate and an increase to the Basic Personal Exemption worth $4.5 billion.

Fast forward one year and a Conservative government was delivering its first budget in 13 years. At issue however was whether income taxes would be raised to allow for a promised 1 point reduction in GST. The CTF provided analysis, issued media statements, published commentaries and earned editorial praise right across the country. We met with decision makers and urged CTF supporters by the thousand to contact the finance minister and prime minister before budget day.

The effort paid off. Along with a GST cut almost all the previous income tax reductions remained intact – no taxpayer was worse off.

The morning after the 2006 budget, the CTF led reaction on front pages of both the Globe and Mail and National Post. As Maclean’s Magazine editor-in-chief Ken Whyte put it succinctly: “The Canadian Taxpayers Federation dominated coverage of this year’s budget.”

An Economic Update delivered in October 2007 cut the GST a further point to 5%, reduced the lowest income tax bracket a half point, increased the Basic Personal Exemption and scheduled a reduction in the general business tax rate from 22% to 15% by 2012.

Not only were these tax cuts measurable, but they were broad-based and accountable (keeping an important election promise to reduce the GST by two points). The CTF had been lobbying hard against “boutique tax cuts” that benefited some, but not all taxpayers.