Better Than Expected

- Program spending growth cut in half, government focuses on core priorities, BUT

- Personal income tax revenues up 23% in 2 years, deficit and debt continue to grow

TORONTO: The Canadian Taxpayers Federation (CTF) reacted to the McGuinty government's 2005-2006 Budget presented by the Minister of Finance at Queen's Park this afternoon.

"It's a brighter picture than we expected. The government appears to have taken our advice, namely, to focus on core priorities and hold the line in other areas," said Tasha Kheiriddin, CTF Ontario Director. "Program spending growth will be 4.5% this year, which is half last year's 9% increase. The government has made spending reductions in at least 10 non-priority departments."

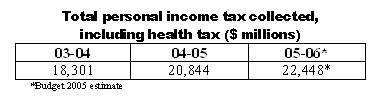

"Unfortunately there's bad news too. Ontario taxpayers are being fleeced like never before. Personal income tax revenues are up an astounding 23% in two years and the budget remains unbalanced," continued Kheiriddin. "The bottom line is this government must trim spending, balance the books, and repeal the health tax before the next election."

Smarter spending commendable, but more needs to be done

Over the past two years, the CTF has repeatedly called on the government to reduce spending in non-priority areas and spend smarter with the tax money it collects. The government's prioritization of health, education and infrastructure in the 2005 budget is commendable, but a much greater effort must be made to contain costs.

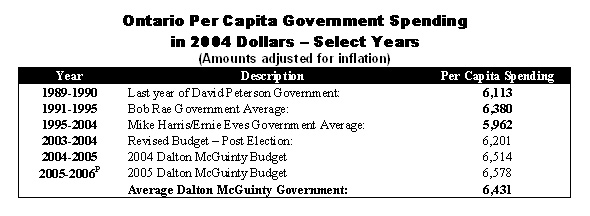

"Spending growth will be held to 4.5% this year, down from a 9% increase last year, and 10% growth in fiscal 2003-04. This reduction is a good start and must continue," said Kheiriddin. "Per capita spending, adjusted for inflation, remains at an all-time high compared to previous governments."

Taxes up again- thanks to the health tax

Queen's Park tax take continues to go through the roof. Personal income tax revenues, which included the health tax, have increased by 23% in two years. The health tax alone brought in $1.75 billion in 04-05, and is forecast to bring in $2.42 billion in 05-06. Corporate tax revenues were up $2.86 billion in 04-05, but are predicted to decline in 05-06.

"The government is balancing the books on the backs of taxpayers. Mr. Sorbara promised not to increase taxes this year - but he's not really keeping that promise, because the health tax will be collected in full this year," said Kheiriddin. "Instead of paying $150 to $450 dollars per person, taxpayers will be on the hook for $300 to $900, bringing in another $700 million to government coffers. And this appears to be a conservative estimate, considering that the amount of tax due is 100% greater than the year before, when the government took in $1.7 billion. We believe the health tax bite will actually be closer to $3.2-billion this fiscal year."

Higher taxes appear to be taking a toll on the economy. Retail sales tax, gas tax and gambling revenues in 2004-05 were all lower than projected. Economic growth is also predicted to slow in 2005-06, with an increase in GDP of only 2%.

"Rather than spend more, this government must return to its promise of no tax increases and repeal the health tax. When the budget is balanced Mr. McGuinty should implement the corporate tax cuts he cancelled when he took office," said Kheiriddin. "If the premier fails to do this, he won't just be breaking his promises, he'll be hurting Ontario's prospects for economic growth."

The continued spectre of deficits

After promising to balance the budget every year in the 2003 election campaign, Premier McGuinty reneged on that commitment and promised to eliminate the deficit by 2007. He is now threatening to break that promise too by projecting deficits until 2008-2009, unless the government uses its reserve fund. Due to last year's repeal of the Balanced Budget Act, Cabinet members will not suffer any drop in salary while the province remains in the red.

"Taxpayers continue to pay through the nose while Cabinet ministers get off scot free. These deficits will cost taxpayers at least $4 billion in interest payments alone, money that could go to health care, education or infrastructure," concluded Kheiriddin. "Should the federal budget pass and new funds be received from Ottawa, the CTF calls on the government to do the responsible thing and apply the revenue to lower the deficit. If the premier does this, his government could eliminate the deficit earlier, and begin to give taxpayers a break while still improving services for Ontarians."

- 30 -

For more information, contact Ontario Director Tasha Kheiriddin at 416-725-0501.