Big Government Conservatism

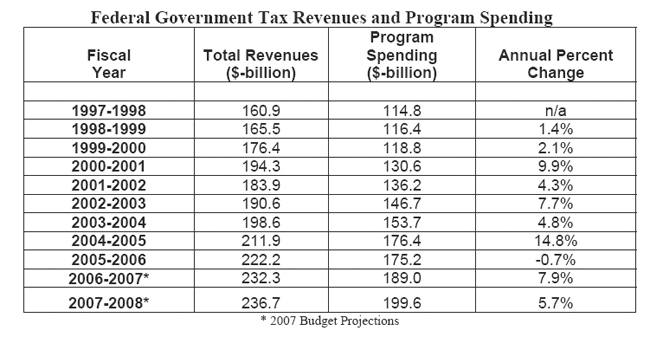

- Program Spending up 7.9% in 2006/07 and projected to rise by 5.7% in 2007/08

- Three dollars of spending for every dollar of tax relief in fiscal '07

- Tax relief limited to families with children and seniors

Ottawa: The Canadian Taxpayers Federation (CTF) reacts to the 2007/08 federal budget, which was tabled in the House of Commons by Finance Minister Jim Flaherty this afternoon.

Finance Minister Delivers Liberal Spending Budget:

Federal government spending on all programs increased from $175.2-billion to $189.0-billion in 2006/07, this represents the third largest increase in percentage terms at 7.9% and the second largest jump in dollars since the budget was balanced in 1997/98. Program spending is budgeted to jump another 5.7 per cent in the upcoming year fiscal 2007/08) to $199.6-billion.

"Rather than reduce the overall tax burden, the Conservative government opted to spend down the federal surplus," said CTF federal director John Williamson. "Program spending is up 7.9% as a result of the finance minister wildly overshooting his original 2006 budget target of 5.3% an astounding 50%. As such, there is little reason to believe Mr. Flaherty will hit next year's budgeted spending boost of 5.7%."

When the 2006 Budget was tabled in May 2006, Williamson observed, "If the government is capable of reducing spending in its non-priority areas and holding growth in others, the Conservatives will be able to offer broadly-based income tax relief in next year's budget." Today, he notes, "The government tabled a budget that dramatically increases the size of the state. As a result, the tax relief is neither broad-based nor all inclusive."

Tax Relief for Canadians:

The 2007 Budget limits tax relief to low-income Canadians, families with children, and it reaffirms already announced tax breaks for seniors, including pension splitting. The Conservative government opted against a broad-based personal income tax cut.

Why is the tax relief so limited in scope In November 2006, Mr. Flaherty told the House of Commons, "...our new economic plan proposes to keep the growth rate of program spending on average below the rate of growth in the economy." And why is this important The minister offered this answer, "To the extent spending growth is kept below the growth in the economy, this will contribute to further reductions in public debt and in taxes given the commitment to dedicate interest savings to tax reductions."

"The spending spree is disappointing. Spending growth exceeded the minister's own target, the economic growth rate. As a result, Canadian taxpayers were shortchanged on the issue of tax relief and will continue paying sky-high tax rates," said Williamson.

In fiscal 2007/08, Ottawa will spend an additional $10.6-billion and lower taxes by less than $3.2-billion. For every three dollars in program spending, taxes will be reduced by one dollar.

The Debt & Tax-Back Guarantee:

Minister Flaherty will reduce Canada's debt by $9.2-billion this year and at least another $3-billion next year. The Conservative government will enact a tax-back guarantee to lower future taxes using interest savings that occur naturally when government debt is reduced. Ottawa's debt now stands at $472.3-billion and annual debt interest payments are more than $34-billion or $93-million each day.

"Ottawa needs a more aggressive debt reduction schedule," said Williamson. "Without such a schedule, future tax relief under the tax-back guarantee will be meager at a time when the federal government sits atop massive budget surpluses. The time to cut taxes is now, not defer tax relief to a future date."

Surplus - Latin for Big Government:

In 2005/06 the federal government's surplus totaled $13.2-billion and this year it will likely be $9.2-billion. The surplus is projected to be $3.3-billion in 2007/08. Between April 1, 2006 and March 31, 2008 - the two-year period under Conservative rule - Ottawa's program spending will rise by an eye popping $24.4-billion or 14%.

"The Conservative government is no better at managing a surplus than the previous Liberal government. There is nothing responsible about over-taxing taxpayers and amassing massive surpluses that fuel more spending," Williamson stressed. "Today, the word 'surplus' means 'big government' as Ottawa's spending has grown by leaps and bounds with the federal surplus. The government will get bigger and bigger so long as legislators have excess tax money to spend."

"Legislators are incapable of demonstrating restraint," concluded Williamson. "And they are also unwilling to return the surplus where it rightly belongs, namely the taxpayers of Canada."