Mayor Misguided over Metro School Division Merger

Taxpayers Federation Cautions against Property Tax Hikes from Metro-Amalgamation

WINNIPEG: The Canadian Taxpayers Federation today objected to Mayor Glen Murray's reckless demand that the province merge Winnipeg's ten school divisions into one. A blanket merger would condemn homeowners from less costly divisions to pay higher school taxes. And chances are school taxes would rise in the city's more costly divisions as well.

"Merger-mania is no panacea for escalating education costs," said Victor Vrsnik, CTF provincial director. "On the contrary, amalgamation of the metro-school divisions will lead to higher taxes for all homeowners. Harmonized collective bargaining agreements will drive up salaries and benefits to the highest common denominator. Issues over harmonized daycare services, transportation and class size limits will also likely favour the more costly option."

"Mayor Murray is better off working toward greater property tax cuts than serving up Robin Hood-like solutions to a school tax formula that rewards the spendthrift divisions and punishes the fiscally responsible ones," added Vrsnik.

The concern over school tax equity and educational outputs will not be served by forcing homeowners in one division to offset spiraling education costs in another. The CTF debunks the myth that divisions like St. James-Assiniboia are able offer low residential school taxes for no other reason than a high commercial property assessment. Division expenditures must also be considered as a factor driving up property taxes.

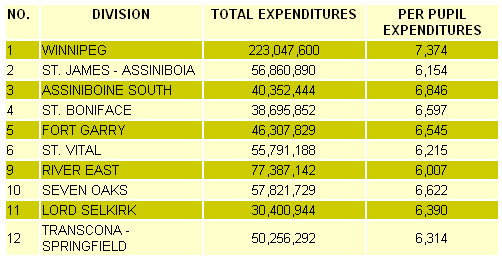

A comparison of per pupil expenditures show that Winnipeg One outstrips the rest of the city's divisions by a country mile. According to the 2001/02 Frame Report Budget, per pupil costs in Winnipeg One are $528 more than second highest Assiniboine South and a whopping $1,367 more than least expensive River East.

"By lowering per pupil costs more in line with River East, Winnipeg One could cut expenditures by $41.3 million per year or 18.5 percent," noted Vrsnik. "That would go a long way to release the school tax burden on Winnipeg One homeowners and businesses."

"Stretching school dollars farther in spendthrift divisions is a far less costly way of closing the school tax gap than through forced amalgamations," concluded Vrsnik.