Tax Savings in '07 (Especially for Families) and Dips Down Again in '08 - Taxpayers Hope Next Budget will Cut Rates

- Provincial Winners: Newfoundland, Quebec & B.C. The Loser: New Brunswick

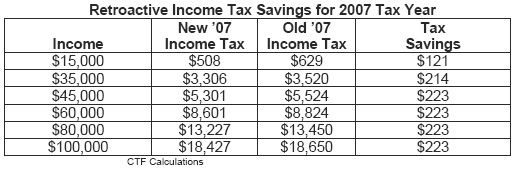

Ottawa: The Canadian Taxpayers Federation (CTF) today released projected income, payroll and sales tax changes kicking in on January 1st, 2008. Also calculated are retroactive personal income tax changes - which apply to the 2007 tax year - announced by the finance minister in the fall economic statement that saw the bottom income tax rate fall to 15% from 15.5% and the basic personal exemption - the amount a person can earn before they pay federal income tax - increase by $671, from $8,929 to $9,600.

"Due to retroactive tax changes announced in the fall, coupled with changes that take effect in the New Year, almost all taxpaying Canadians will pay the Taxman less in 2007 and 2008. The exception is in New Brunswick," stated CTF federal director John Williamson. "Thanks to the broad-based tax relief announced in the economic statement, the average taxpayer's retroactive tax savings this year will be $223. This will climb to $272 after factoring in changes that take place next year. Families will save even more thanks to a new child credit worth $300 per child and a higher spousal exemption, which were also enacted for the '07 tax year. Plus let's not forget the January 1st GST reduction. While harder to quantify, it will save the typical Canadian household between $150 and $200 annually."

"But taxpayers shouldn't clap too loudly as Ottawa's 'new' 15% rate simply restores the lowest income tax rate to what it was in 2005 before the Conservative finance minister raised it in his first budget. Jim Flaherty should be working to cut personal income tax rates, not patting himself on the back for returning them to the level they were when he came into office."

To see the income and payroll tax changes in 2007 and 2008 for various income levels, households and for all 10 provinces go to Chart #1.

Tax Relief in 2008 - Only Modest Gains due to Indexation

Additional tax reductions next year are due mostly to the indexation of the personal income tax brackets. Other specific tax changes include:

Payroll Taxes: Minuscule EI Reduction and Bigger CPP Bite

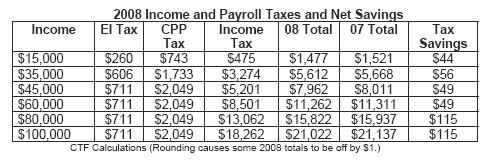

Effective January 1, 2008, the employee rate per $100 of insurable earnings will be adjusted to $1.73, a reduction of 7 cents from its current level of $1.80. The corresponding employer rate will be adjusted to $2.42, a reduction of 10 cents from its current level of $2.52. The maximum insurable earnings will rise from $40,000 to $41,100 which is the ceiling up to which EI premiums are collected. Employees will therefore pay a maximum of $711.03 and employers $994.62 for a total EI payment of $1,705.65.

"With a $3.3-billion surplus in the EI fund last year, Ottawa should cut rates and match EI revenues to EI payments, allowing for only a modest reserve, and harmonize the employer rate with those of employees," said Williamson. "Cutting this tax will help job creation and give manufacturers a break at a time when they are struggling with dollar parity."

Under the Canada Pension Plan, the maximum pensionable earnings for 2008 will be $44,900 (up from $43,700 in 2007) and the basic exemption amount will remain unchanged at $3,500. The employee and employer contribution rates will each remain unchanged at 4.95%. Because the contribution rate is staying the same while the threshold (ceiling) increases, most taxpayers will pay slightly more in CPP payments in 2008. Employees and employers will each pay a maximum of $2,049.30 for a total CPP payment of $4,098.60. See Chart #2 for EI and CPP tax payments and increases.

"The net payroll tax bill on workers will increase because the EI tax reductions will be gobbled up by a higher EI threshold and rising CPP payments. Average worker will pay $50.43 more in payroll taxes and employers $46.02 more," said Williamson. "Ottawa is wrong to increase the EI tax ceiling when the program continues to amass surpluses. It is another example of giving a tax break with one hand, by lowering the EI tax rate, and taking it away with the other, by raising the threshold."

A 5% GST is a $5-billion Annual Tax Savings

The GST will be reduced by a further one percentage point on January 1, fulfilling the Conservatives' marquee pledge to reduce the tax by two points. This additional cut will save the average household between $150 and $200 annually. "While some have criticized cutting the GST, it is a broad-based tax cut that puts $5-billion back in the pockets of over-taxed Canadians," observed Williamson. "And given that this is the second point cut, the total household savings will be between $300 and $400 each year. This is good news particularly since $10-billion in the pockets of Canadian consumers is preferable to Ottawa hoarding the cash."

Provincial Income Tax Changes

Three provinces have additional relief coming to its taxpayers in the New Year. Newfoundland and Labrador reduced all provincial income tax rates and has eliminated its provincial surtax altogether. The typical taxpayer will save $420 in provincial and federal taxes next year (plus GST savings). Quebec rates remain the same although the thresholds have increased substantially which will result in the largest tax savings in the country as of January 1st. The average Quebecer will pay $500 less next year (plus any GST savings). The tax savings will increase in each province as incomes rise above $45,000. Meanwhile, British Columbia has cut all of its provincial income tax rates except the top one which also results in additional savings. As such, average taxpayers in Lotus Land save $223 (again, plus GST savings).

New Brunswick's provincial income tax increase in 2007 means all individuals earning more than $52,700 paid more income tax this year. Individuals with incomes below $52,700 paid less thanks to federal tax reductions, but their savings were smaller than other Canadian taxpayers because of the province's tax hike.

See Chart #3 for provincial tax rates/comparisons.

More Relief Needed to Eliminate Structural Over-taxation

While the tax relief announced in Ottawa's annual economic statement was a good start, Canadians remain over-taxed. "More must be done to reduce personal income taxes. It is not sufficient for parliamentarians to only discuss cutting taxes for low-income Canadians. According to the OECD and even Canada's finance department, our personal income tax burden remains the highest of the G-7 nations. This standing has not changed in almost a decade and means the French and Italians pay less personal income tax than Canadians," noted Williamson.

"Broad-based tax relief is necessary to ensure all income levels benefit from lower taxes. Ottawa must focus on further reducing personal income taxes in the 2008 budget and we can suggest several options. At a minimum the Conservative government could chop the two middle rates of 26% and 22% a point each and raise the income threshold at which the top rate of 29% begins to apply to $200,000," Williamson said. "This proposal can hardly be called radical as it was the tax relief model the Liberals campaigned on in the last election.

"Liberal leader Stéphane Dion would have a hard time voting against his party's own tax proposal if Minister Flaherty were to enact it in the next budget. While the Liberal caucus might squirm, it would be a good tax cut for overburdened Canadians. The goal is to lower income taxes and very few taxpayers will complain if it means implementing the Liberal's old plan under a Conservative banner."

-30-

For more information, contact John Williamson or Adam Taylor at 613-234-6554.