The Big Lie

TORONTO: The Canadian Taxpayers Federation (CTF) condemns the McGuinty government's 2004 Budget as a complete breach of trust with the taxpayers of Ontario.

"They have totally broken faith with the voters of this province. The Liberals campaigned on a platform of fiscal responsibility, balanced budgets, and no tax hikes," said Tasha Kheiriddin, CTF Ontario Director. "At no time did they talk of health taxes or any other multi-billion dollar tax increases. In fact, they ran election ads and signed a public pledge with the CTF to do the opposite. They promised a balanced budget yet they won't deliver one for another 3 years. Ontario has returned to the days of rampant tax-and-spend liberalism."

The government's budget numbers show revenues will increase by 15% this year (2004-05) and help bring the purported $6-billion deficit down to $2.2-billion. "Had Mr. McGuinty eliminated the $1.2-billion in so-called Tory waste he identified in the election, the Liberals would have only had to reduce spending by an additional $1-billion to balance the budget," said Kheiriddin. "Alternatively, they could have spared taxpayers a $1.6-billion tax increase this year and a $3.2-billion increase every year thereafter."

"The McGuinty promise not to raise taxes was a lie. Their deficit numbers were a lie. Their pledge to eliminate waste was a lie. This government is completely unworthy of the people's trust," said Kheiriddin.

The Taxpayer Protection Act and Balanced Budget ActM

This budget declares war on Ontario taxpayers. It will gut the only legal protection taxpayers have from tax happy politicians, the Taxpayer Protection Act and Balanced Budget Act. These laws give voters the final say on tax increases. The Liberal government proposes to replace the Balanced Budget Act with a so-called Fiscal Transparency and Accountability Act - and remove the 25% salary penalties on Cabinet members for failing to balance the budget. The penalty, under the current act, jumps to 50% in the second year of a deficit budget.

"It is shameful that Cabinet ministers will impose higher taxes on the citizens of this province while escaping responsibility for failing to do their job. They're like CEOs who get big pay packages while their companies lose money and workers are laid off," commented Kheiriddin. "Although ministers will take a pay cut this year, by changing the law they'll escape it next year, and the year after, when they will still be running deficits."

The government has also indicated that it will amend the Taxpayer Protection Act to allow the tax increases outlined in this budget. "Rather than call a province-wide referendum on their new health tax, as the law mandates, the Liberals have decided to change the law. This is cowardly. If they believe people want a tax, let them seek their approval before they impose it."

Rising Taxes

This budget can be summed up in three words: less for more. Taxpayers will get the same services (such as vehicle licences) or fewer services (such as delisted health care services) while paying higher fees and taxes.

The government proposes to increase taxes on alcohol, beer and cigarettes. Taxes already compose over 80% of the price of alcoholic beverages purchased in Ontario. Increasing cigarette taxes will increase cigarette smuggling. This has happened before in Ontario. Raising these taxes virtually guarantees an increase in illegal cigarette traffic - and will eat up part of these taxes to combat the resulting crime.

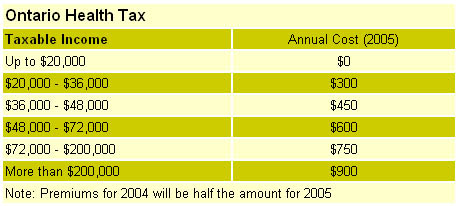

The biggest increase in taxes is the new Liberal health care tax. The impact on taxpayers will be as follows:

These health taxes unfairly penalize all taxpayers, particularly low and middle-income earners. A taxpayer earning $20,000 will pay $300 a year for health care, which represents 1.5% of total income. A taxpayer earning $70,000 will pay $600 a year, or 0.86% of total income.

"The Liberals may pat themselves on the back as champions of the less fortunate, but the reality is they will increase low income taxpayers' bills more than any other group's," said Kheiriddin. "Add to that the disproportionate impact of consumption taxes on liquor and cigarettes, and it's the little guy who loses the most under this budget."

In addition, during the election, the Liberals promised not to increase the Fair Share Health Levy on high-income earners. By imposing additional premiums of $750 and $900 on top wage earners, they are effectively increasing that levy, which forms part of the income surtax. Ontario is now competing with Quebec for the title of highest upper income tax rates in North America.

Debt, Spending and Revenue - The Real Story

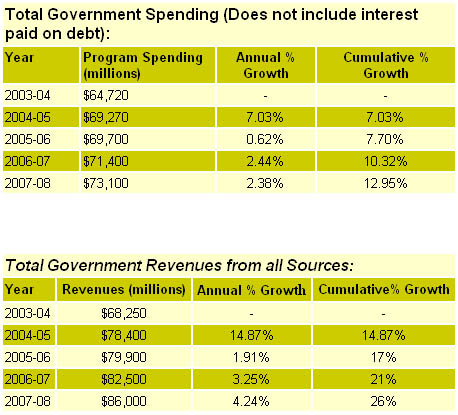

The Liberals failed to balance the budget last year, this year, and for the next two years. The result of this will be increased interest payments and therefore less money for programs such as health and education. But the government's numbers don't tell the whole story.

The government has reduced its deficit this year on the back of revenue growth alone - from a purported $6-billion to $2.2-billion shortfall. In other words, to balance the books this year would have required only a $2.2-billion spending reduction - or a $1-billion reduction if the government had eliminated the "Tory waste" Mr. McGuinty talked about in the election.

"If this waste was already identified, why won't they eliminate it in this fiscal year Or was this just another campaign promise that turned out to be a lie " Kheiriddin said. "The numbers show they don't have a revenue problem - they have a spending problem. Revenues are up 15% this year and they still can't balance the books. And if you factor in the government's $1-billion reserve, there wouldn't be a deficit at all."

Concluded Kheiriddin, "This budget is one big lie and, rest assured, taxpayers won't take it lying down."