Gas taxes fueling high pump prices across Nova Scotia: Report

HALIFAX, NS: The Canadian Taxpayers Federation is calling for gas tax relief after releasing the 27th annual Gas Tax Honesty Report that shines a light on hidden taxes drivers pay at the pumps.

“Over a third of the price Nova Scotians pay at the pump is taxes,” said Devin Drover, CTF Atlantic Director. “Both Prime Minister Mark Carney and Premier Tim Houston need to cut their taxes on fuel that are making life more expensive.”

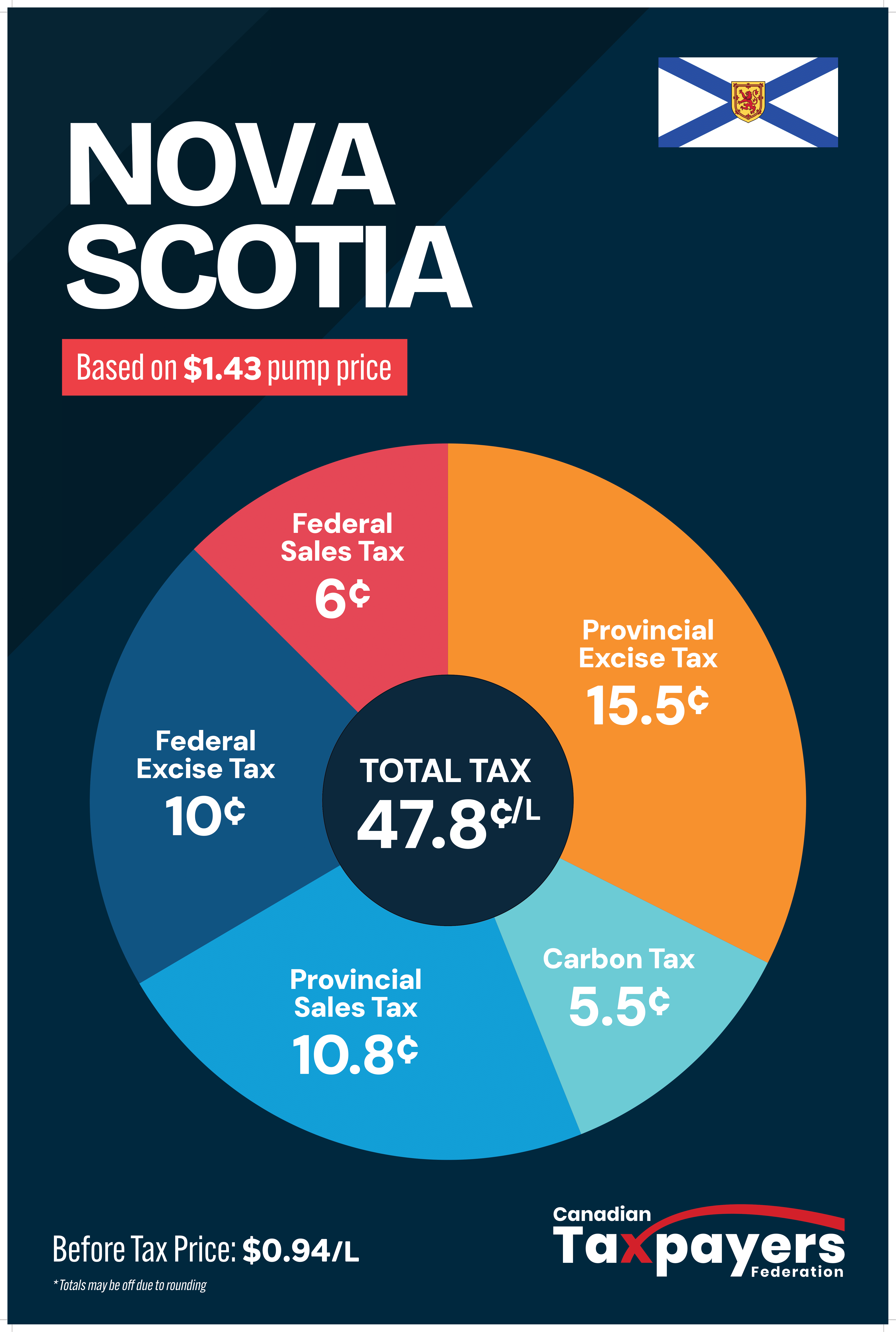

Drivers in Nova Scotia are paying about 48 cents in federal and provincial taxes per litre of gasoline when they fill up, according to the CTF’s Gas Tax Honesty Report.

This means for a 64-litre fill up, just gas taxes cost drivers $30.57.

The federal gas tax costs 10 cents per litre. The federal government also charges a hidden carbon tax embedded in fuel standards that adds 5.5 cents per litre to the cost of gasoline.

The provincial gas tax costs taxpayers about 15.5 cents per litre.

The remainder comes from harmonized sales tax, which is charged on top of the price after other taxes have already been added.

Meanwhile, other provinces are cutting gas taxes. Newfoundland and Labrador cut its provincial gas tax by eight cents per litre in June 2022, saving an average Newfoundlander and Labradorian more than $5 on each 64-litre fill-up.

Ontario also cut gas taxes to save drivers money.

“Houston needs to follow the example set by Premier John Hogan in Newfoundland and Labrador,” Drover said. “Other provinces have been able to cut gas taxes to make life more affordable and the government of Nova Scotia needs to do the same.”