Status quo for Manitobans as Tax Freedom Day finally arrives

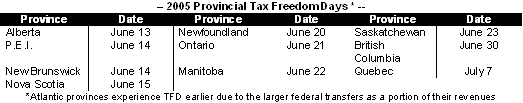

WINNIPEG/CALGARY: The Canadian Taxpayers Federation (CTF) today responded to news from the Fraser Institute that Tax Freedom Day for Canada will occur on Sunday, June 26th and for Manitoba occurred on Wednesday June 22nd.

Each year, the Fraser Institute calculates Tax Freedom Day as the day of the year when taxpayers finally start working for themselves after paying the total tax bill imposed on them by governments. Prior to the Tax Freedom Day, the equivalent of all money earned by taxpayers is required to pay the numerous taxes, fees and levies imposed by federal, provincial and municipal governments. The original release and calculations is available at: www.fraserinstitute.ca

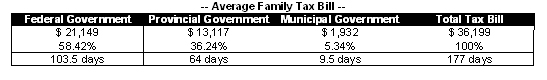

"These numbers serve as a constant reminder of the impact of government taxation in every taxpayer's life," stated provincial director Adrienne Batra. "This year Canadians will work 177 days to keep the wheels of all three levels of government turning, eating up 48 per cent of average annual household income," added Batra.

A Manitoba family earning $71,065 a year will pay $33,463 in taxes or 46.9% of their entire income. These figures include the following taxes: income tax, sales tax, liquor, tobacco and amusement tax, social security, pension, property taxes, import duties, profits tax, natural resources and other taxes.

Manitobans are also no further ahead in spite of modest tax reductions as bracket creep continues unabated. "Although there has been a marginal decrease in the middle tax bracket, we are feeling the squeeze from bracket creep and government fees, most notably since the NDP government's expansion of the Provincial Sales Tax to professional services took effect," stated Batra.

According to the Fraser Institute, "the rising costs of Canada's health care and retirement systems, coupled with failure of Canadian government's to properly address these issues, could well lead to increased future tax burdens and later Tax Freedom Days."

"This statement should serve as a warning to all levels of government that unless they show some leadership and cut costs and control spending, Canadians will not have the freedom to plan for their future by investing and reducing personal levels of debt," Batra concluded.