Taxpayers report warns that B.C.’s debt is exploding

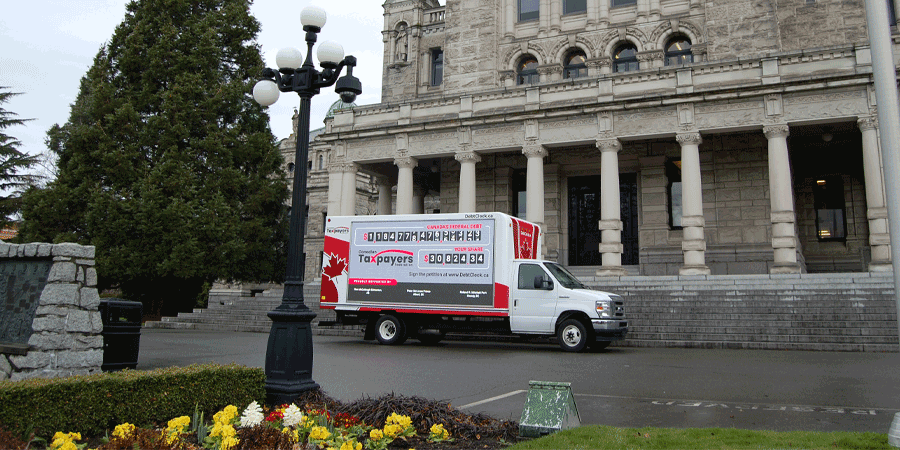

VANCOUVER, B.C.: The Canadian Taxpayers Federation released a new report today warning British Columbians about the province’s exploding debt.

“British Columbia’s public debt is exploding,” said Carson Binda, B.C. Director for the Canadian Taxpayers Federation. “Premier David Eby needs to put down the taxpayer credit card before he drives our finances into the ditch.”

Key findings of the CTF’s report include:

- Total provincial debt has increased by 136 per cent between 2018-19 and 2025-26

- Every British Columbian now owes the equivalent of $27,000 towards the provincial debt

- Interest payments on the debt are $5.3 billion this year

- Interest payments are projected to rise to $7.6 billion by 2027-28

“British Columbians are being buried in debt and crushed by the interest charges on that debt,” Binda said. “Every dollar that goes out the door through debt interest is money that’s not going towards core service or making life more affordable for taxpayers through tax cuts.”

The province will spend $5.3 billion on debt interest this year, according to government forecasts. That is the equivalent of building 159 new schools with the capacity for 42,000 students, or paying the salaries of 7,800 nurses for a decade.

“Debt interest is costing British Columbians more money that the province takes in fuel taxes and property taxes combined,” Binda said. “Debt interest is going to rise dramatically over the next three budget cycles, leaving taxpayers with big costs.”

Government forecasts suggest that interest costs will increase by 43 per cent by 2027-28. British Columbians will be paying $7.6 billion in interest in 2027-28, which is $1,330 per person.