Income Tax Hike Will Cost Manitobans $13 Million More This Year

- Time to join other seven provinces that ended secret income tax hikes years ago

The Canadian Taxpayers Federation (CTF) today called on the Manitoba government to stop secretly raising personal income taxes on Manitobans through a secretive form of taxation known as “bracket creep.” The CTF estimates the secret tax hike will cost Manitobans $13 million more this year alone.

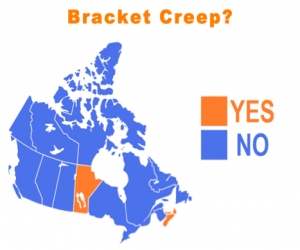

“Bracket creep” occurs when governments don’t automatically index tax brackets for inflation. Thus, if someone’s income merely keeps pace with inflation, they can’t buy more goods and services, but the government can start charging taxes a higher tax rate. Seven out of ten provinces have recognized the unfairness of “bracket creep” and they put a stop to it.

“We know the province is running a deficit so we’re not asking for a tax cut,” said CTF Prairie Director Colin Craig. “We’re saying don’t secretly raise income taxes through bracket creep. Most people have no idea this problem exists so the province continues to get away with it.”

“It’s time to do what seven out of ten provinces, and all three territories, have done and end bracket creep,” said Craig.

According to the CTF, had tax brackets been indexed for inflation back in 1999, Manitobans would save the following this year:

|

Income |

Savings |

|

$40,000 (or more) |

$162 |

|

$78,000 (or more) |

$669 |

“Clearly, if left untreated, bracket creep can really add up over time,” added Craig.

The CTF has produced an easy to understand video on “bracket creep” to show how it works - http://www.youtube.com/watch?v=vklhGNxYnhU