Tax Freedom Day Arrives on Wednesday

- Liberal and NDP-led provinces bigger tax cutters than the federal "Conservatives"

- $29-billion surplus proves Tax Freedom Day is much too late in Canada

- Not surprising only 13% of Canadians felt they "benefited" from the boutique tax cuts in 2007 federal budget

Edmonton: The Canadian Taxpayers Federation (CTF) today responded to news from the Fraser Institute that Tax Freedom Day for Canadians will occur on Wednesday, June 20th. Tax Freedom Day is the day of the year when taxpayers finally start working for themselves after working since January 1st to pay the equivalent of the total tax bill imposed on them by all levels of government. The Institute's release and calculations are available at: www.fraserinstitute.ca.

"Canadians this year will work 170 days to feed the appetite of all three orders of government, eating up 46.5 per cent of average family income," stated CTF Alberta director Scott Hennig. "Incredibly, the federal government continues to ignore broad-based income tax relief, instead opting to increase spending and sprinkle 'boutique' tax cuts to favored electoral constituencies."

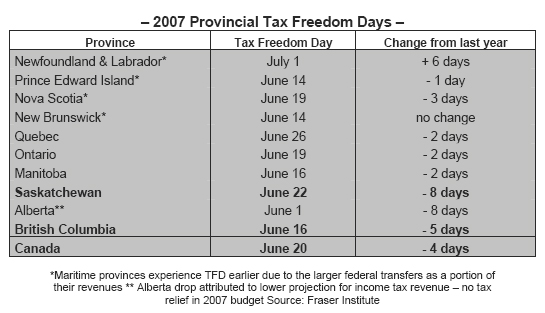

Despite record surpluses, Tax Freedom Day dropped a mere 4 days Canada-wide last year, largely on the strength of a full year's impact of the GST cut. More notably, Saskatchewan saw a drop of 8 days from last year and British Columbia saw a 5 day drop from last year. These reductions can be attributed to reductions in the PST, corporate income tax, and capital tax in Saskatchewan, and a large personal income tax cut in BC.

"Clearly the NDP government in Saskatchewan and the Liberal government in British Columbia both understand the need for broad-based tax relief," continued Hennig. "Yet, the 'Conservatives' in Ottawa continue to act like our tax dollars are theirs to use in an effort to buy votes."

A recent release by Statistics Canada showed all three levels of Canadian governments, including the Canada and Quebec pension plans, recorded a combined surplus of $29-billion this past year. Statistics Canada pointed out it's only the second time in 20 years the combined surplus has been that high.

"Our politicians just don't seem to get it," continued Hennig. "They all should be ashamed they aren't offering significant, broad-based tax relief to Canadians when there is $29-billion in structural over-taxation this year alone."

A recent public opinion poll conducted by Innovative Research Group for the CTF showed only 13 per cent of Canadians felt they would benefit by the tax cuts in the 2007 federal budget. Complete results can be seen by clicking here.

"When you cut the GST with one hand, raise personal income taxes with the other, and then offer a smattering of boutique tax cuts to transit riders, truck drivers and parents who put their kids into an eligible sport program - it's no surprise Tax Freedom Day is only making incremental gains," concluded Hennig.

-30-

For more information, contact Alberta director Scott Hennig at 1-800-661-0187 or 780-953-4484 (cell)