Trudeau government considering truck tax recommendation

VANCOUVER, B.C.: The Canadian Taxpayers Federation is calling on the federal government to categorically reject a recommendation for a new tax on trucks.

“It’s pretty tough to stuff plywood into a Prius or pull a horse trailer with a Tesla, so the Trudeau government needs to reject any recommendation to tax trucks that millions of Canadians depend on for their livelihoods,” said Kris Sims, B.C. Director for the Canadian Taxpayers Federation.

The proposal to hit both light duty and heavy duty trucks with a tax is in an official report from Environment Canada which includes a foreword from Environment Minister Steven Guilbeault, who writes: “This is our ambitious and achievable roadmap.”

The recommendation in the report reads: “Consider adopting an approach that combines financial incentives for the purchase of zero-emission vehicles with fees for the purchase of fuel-inefficient internal combustion engine vehicles. Broaden Canada’s existing Green Levy (Excise Tax) for Fuel Inefficient Vehicles to include additional ICE vehicle types, such as pickup trucks.”

Currently the Green Levy Excise Tax only applies to larger SUVs that use more than 13 litres per 100 km, and it exempts trucks.

The report recommends removing this exemption.

Currently, the federal government charges a $1,000 tax for an SUV or a passenger van that uses more than 13 litres per 100 km; $2,000 if it uses more than 14 litres per 100 km; $3,000 if it uses more than 15 litres per 100 km; and, $4,000 if it uses more than 16 litres per 100 km.

For example, the federal government charges a $3,000 tax on new Nissan Armada SUVs.

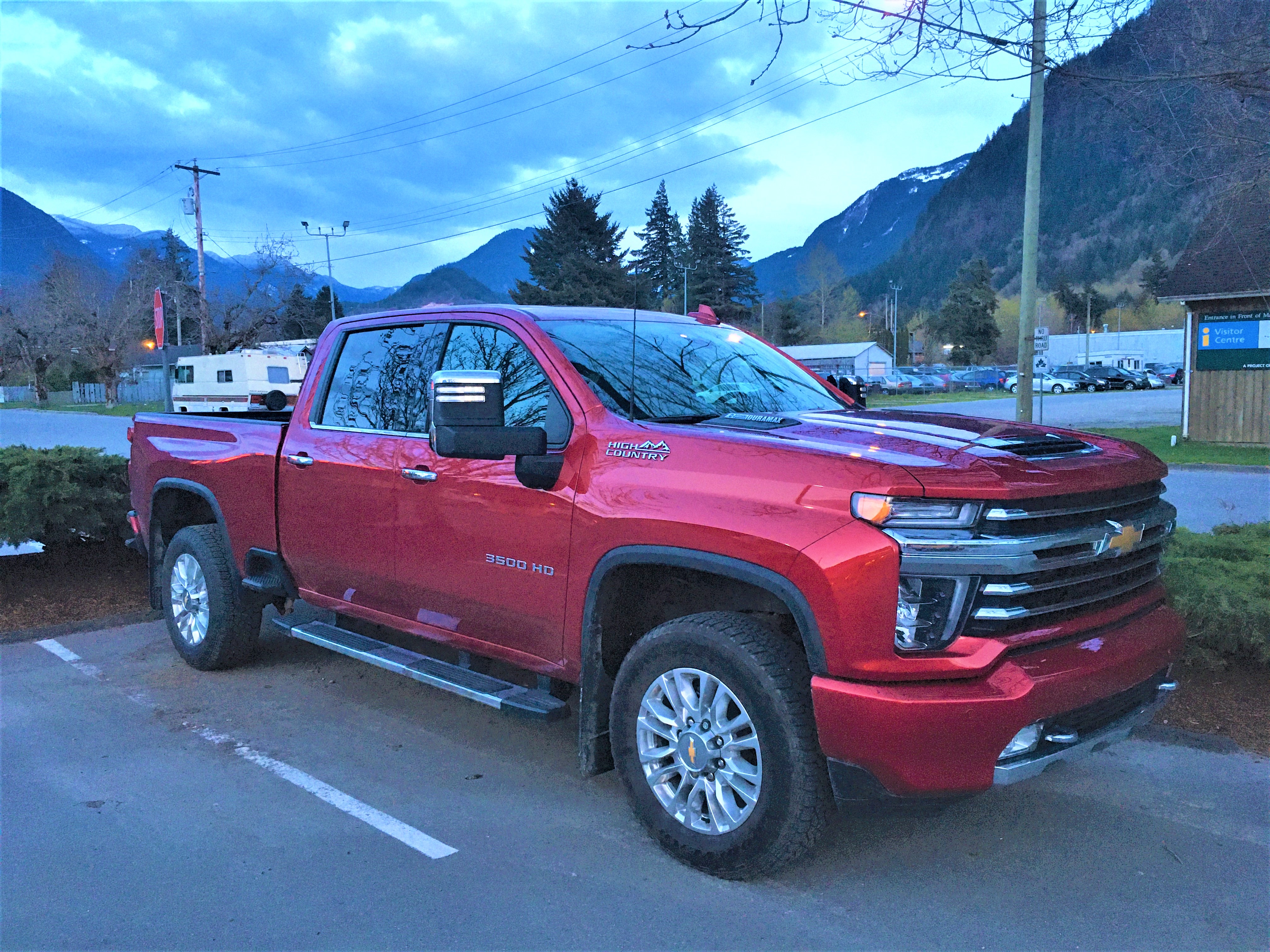

Based on those regulations, if the government abolished the truck exemption, light duty pickups such as Ford F-150s, Toyota Tacomas, Chevrolet Silverados and Ram 1500s would get a $1,000 tax. Meanwhile, heavy duty trucks, like the Ram 3500, would get hit with a $4,000 tax.

Guilbeault called the concerns over this truck tax recommendation “disinformation” on Twitter and stated: “This so-called fee on trucks doesn’t exist. It’s fear mongering, plain and simple.”

“If the minister wants to clarify and categorically reject a new tax on trucks, he should go ahead and do so, but this recommendation for a truck tax is in his ministry’s report in black-and-white, and Canadians have every right to be concerned about it,” said Sims.