To: Hon. Jim Flaherty, Minister of Finance, Government of Canada

Real Tax Relief

Minister Flaherty,

Let me begin by congratulating you for raising expectations that tax relief will be an integral part of the 2007 Budget, which newspapers report will be tabled in Parliament on March 20. Taxpayers are enthused about the tax changes you will announce. Even Stephen Harper - Canada's middle-class prime minister - has been speaking out on behalf of taxpayers.

Earlier this month, Mr. Harper outlined in a speech his government's agenda for the next year. Along with a commitment to get tough on criminals, rebuild the armed forces, reform Canada's antiquated Senate by electing its members to eight-year terms, and protect the environment; he told Canadians to expect further tax cuts.

He also discussed how the Conservative government has (mostly) implemented four of its five election priorities - enacting the Federal Accountability Act, reducing the GST from seven to six per cent; replacing a planned institutional daycare scheme with a universal $1,200 child care allowance; and tabling legislation to get tough on criminals. Only the patient wait-times guarantee for medically necessary services remains on the drafting table.

On taxes, however, he said the 2006 Budget provided Canadians $20-billion in tax relief. Mr. Flaherty, since the actual tax relief is half this amount, you must be aware the Prime Minister misspoke. You need to chat with him about this before he finds himself in trouble with the opposition in Question Period.

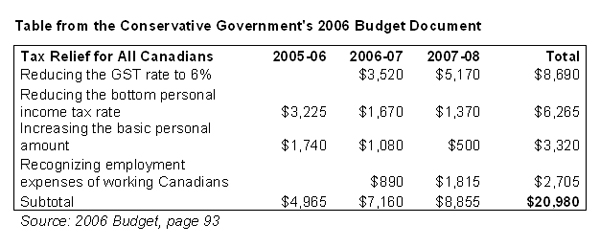

The Prime Minister was likely citing information from the last budget, which pegged tax relief for all Canadians at $20.98-billion. (You can find this information on the associated table or page 93 of Budget Plan 2006.)

There are two errors with the budget data.

First, included in the budget's tax savings calculation is almost $5-billion in income tax relief provided in the 2005/06 fiscal year by the then-governing Liberal Party. Mr. Flaherty, why was this amount included when it is the result of tax changes made by the old government The Conservative Party was elected on January 23, 2006, and the new government sworn in on February 6, exactly two weeks later. When the Harper cabinet was appointed only 60 days remained in the fiscal year. The Conservative government is no more responsible for tax relief in 2005/06 than it is liable for the reckless spending rung up by the Liberals.

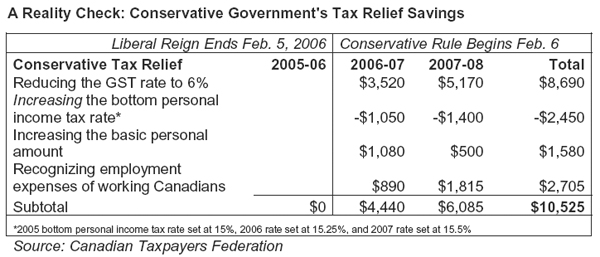

The second mistake is less obvious until Canadians examine their paycheques. The 2006 Budget wrongly states the bottom personal income tax rate was reduced. In fact, the rate stood at 15% in 2005. It increased to 15.25% last year and 15.5% on January 1, 2007. This is a tax increase and because of it Canadians are paying more tax to Ottawa. Rather than a reduction of $1.67-billion in 2006 and $1.37-billion in 2007 - as erroneously reported in the budget - the quarter-point hikes mean Canadians paid $1-billon more last year and will pay $1.4-billion more this year. (See second table for Conservative Tax Relief.)

These calculations tell us the tax relief contained in the last budget totalled $10.5-billion and was not nearly as dramatic as the government would like taxpayers to believe. More should be done to lighten the tax burden on individuals and families. The upcoming budget provides such an opportunity.

Governments exaggerate their tax relief. And why would they not Canadians are, after all, crying out for reduced income taxes. Take the Liberal's own hype in government. When in power, the true size of the 2000 tax relief program was distorted when the Grits claimed it to be a $100.5-billion tax cut. In actual fact, $20.7-billion of this amount included the ending of bracket creep, which did not lower taxes, but simply indexed brackets to inflation.

A massive $28-billion increase in Canada Pension Plan tax premiums was omitted. And lastly, almost $6-billion in Canada Child Tax Benefit payments to families with kids was incorrectly identified as tax relief, instead of being classified as government spending. The real five-year tax cut, once fully implemented at the end of 2004, amounted to $46-billion - a far cry from the $100-billion "as advertised." Nonetheless, welcomed all the same!

Mr. Flaherty, our organization applauds your government's one-point GST reduction. Should the government provide Canadians with additional tax relief, control spending and reduce its debt, we will do so again. We also recognize the $1.24-billion in targeted tax relief provided in the last budget will help some Canadians. But surely you will agree that all Canadians are entitled to meaningful income tax relief Taxpayers hope you will act on your convictions by reducing tax rates or increasing the tax thresholds.

Good luck.