B.C. government should cut gas taxes to help affordability

Our government needs an affordability reality check.

With gas prices in British Columbia shattering all-time records this autumn, Premier John Horgan’s government is asleep at the wheel. Prices hit $2.33 in the Lower Mainland and almost $2 up north in Prince George.

At those prices, it costs a family $175 to fill their minivan in Langley.

What’s left for groceries after that?

Everyday working people cannot afford this and the B.C. government is fully capable of helping to ease this burden.

Gas taxes are making everything more expensive and they are not meeting their objectives when it comes to reducing emissions.

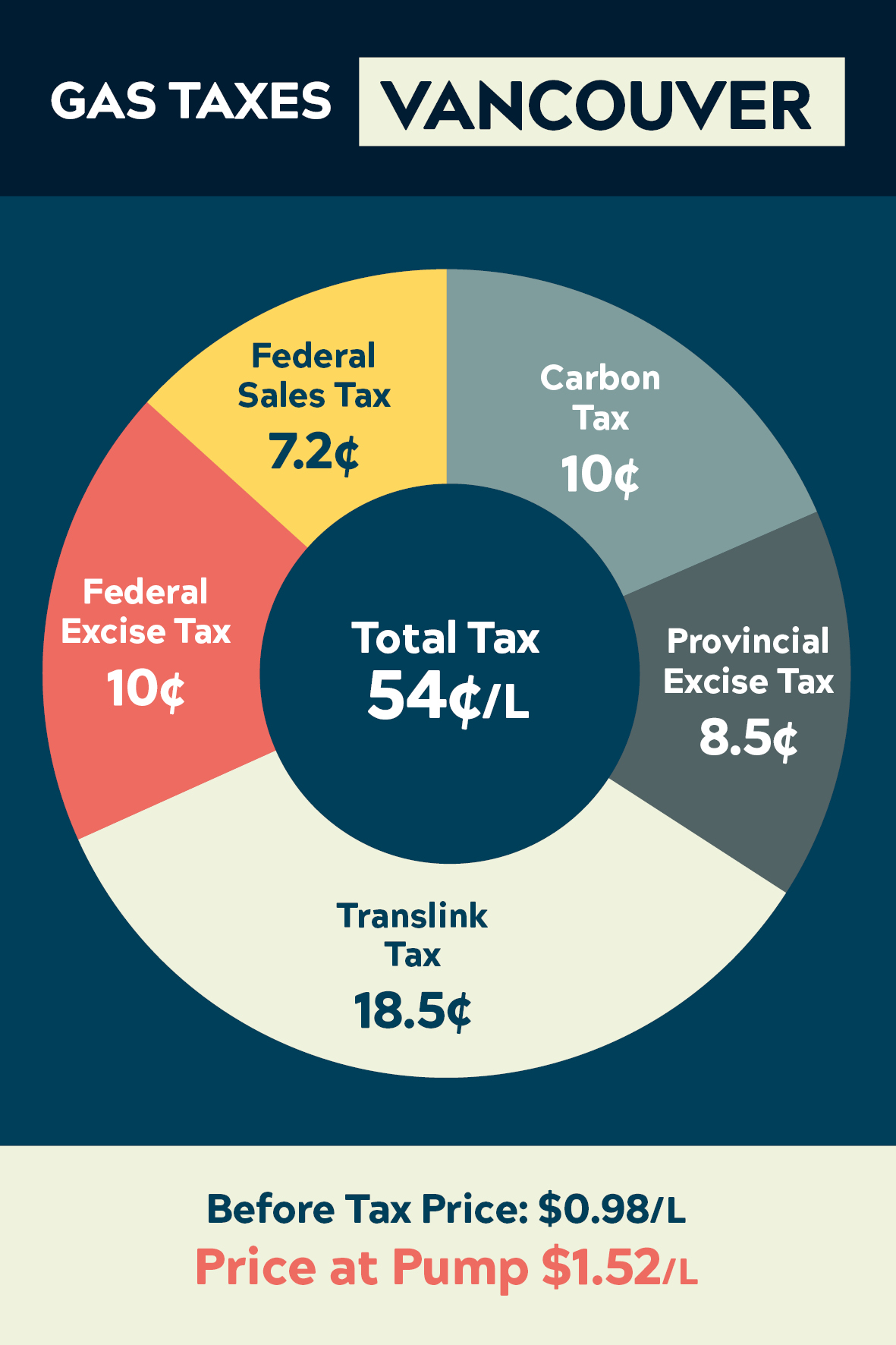

Right now, gas taxes account for 75 cents of the cost of a litre of gasoline in the Vancouver area. Slightly less up north. The provincial take is 55 cents per litre, including transit taxes, an excise tax and two carbon taxes.

Consider a family of four living in any suburb of the Lower Mainland. Dad is a landscaper and Mom is a teacher who works at the kids’ middle school.

Mom takes the kids to school in the family’s minivan which has a 75-litre fuel tank. Since folks are paying about 75 cents per litre in municipal, federal and provincial fuel taxes, that means the family is paying $56 in gas taxes every other week when they fill up the minivan.

Dad drives a Ford F-150 because he needs to haul mulch to a few different landscaping sites, which is just not possible in a Prius. He does a lot of driving to and from different sites and fills up his 120-litre fuel tank twice a week. That costs him $180 in gas taxes every single week – just getting to and from work.

On the bare necessities of taking the kids to school, driving to work, and the weekly Costco run, this family pays $832 in gas taxes a month. That’s about $10,000 a year.

Premier John Horgan says that he would like to see everyone driving electric vehicles. But supply chain shortages mean that even people who can afford to buy new electric vehicles face long waits to actually buy one.

Now, factor in the carbon tax on the natural gas that heats a family’s home in the winter. With the carbon tax set at 9.79 cents per cubic metre of natural gas, it will cost an average household about $212 extra for the luxury of staying warm this winter.

These are the most blatant ways gas taxes hurt families, but it does not end there.

Food is getting more expensive. Fuel taxes make it more expensive to transport food from the farm to your table. The carbon tax also makes the propane and natural gas-powered grain dryers more expensive to run.

As we are in the middle of a housing crisis, gas taxes make it even more expensive to build new homes.

Unfortunately, all of this pocketbook pain isn’t delivering environmental gain.

B.C. has the highest carbon taxes in North America, but between 2007 and 2019, we saw an increase in emissions from 65.5 to 67.9 metric tonnes of carbon equivalent. While 2020 saw a slight decrease in B.C.’s baseline emissions, our economy had shut because of a global pandemic. In normal times, the carbon tax simply has not decreased greenhouse gas emissions.

There are people who will argue that our province needs the revenue that gas taxes generate. In reality, even a little spending restraint could relieve budget pressures. Here’s a place to start: Horgan should end the $30-million he hands out to politicians via the per-vote subsidy. Most drivers would welcome some relief at the pumps in exchange for fewer lawn signs and attack ads come election time.

Provinces across the country and more than 51 national governments, have frozen or reduced fuel taxes while prices and inflation hit record highs.

Here in B.C., our government has failed to take any meaningful steps to combat the devastating impact of sky-high fuel prices.

This provincial government likes to talk about affordability, but they are asleep at the wheel while our province drifts further into economic hardship for B.C. families.

-30-