B.C.’s budget is a dumpster fire for taxpayers

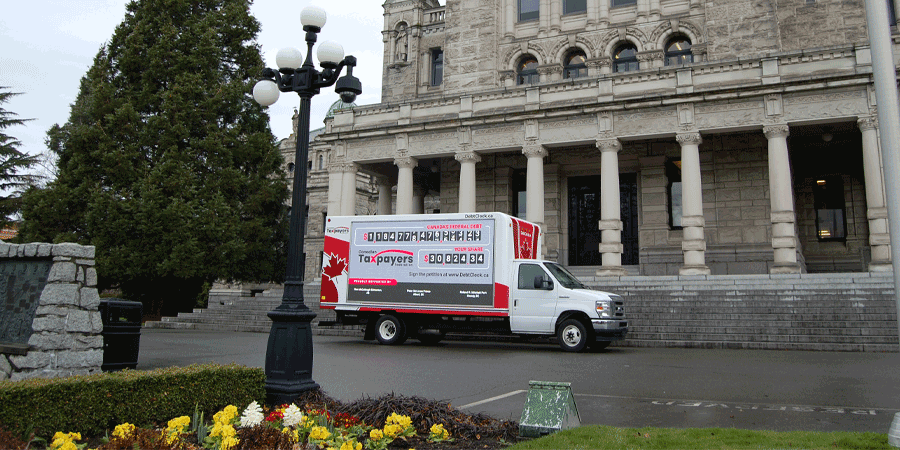

Finance Minister Katrine Conroy is pushing British Columbia deeper and deeper into an unsustainable debt spiral, with sky-high taxes and no plans to balance the budget.

This year’s deficit is a record-setting $7.9 billion. That’s the largest deficit in the province’s history, far higher than was ever recorded during the COVID-19 pandemic.

After years of chronic deficits, interest charges are rising and gobbling up a huge amount of taxpayer cash. This year alone, taxpayers are on the hook for $4.1 billion in debt interest payments. To put that eye-watering number into context, that’s roughly $820 per British Columbian this year alone. Over the next three years, interest on the debt will cost taxpayers $14.6 billion.

The interest on the B.C.’s government debt is more money than the government collects in the carbon and motor fuels tax combined. Interest payments are so high compared with spending levels in most ministries that the Ministry of Debt Interest is now the fourth largest in the province.

Surely British Columbians would rather keep that money at home, instead of sending billions out the door to bond managers on Bay Street. British Columbians desperately need tax relief. Instead, taxpayers are working harder than ever just to see the government burn more and more money on debt interest.

Conroy and Premier David Eby also have no plans to balance the budget. That’s a problem because it means more debt will be added every year, which in turn means more interest payments. Over the next three years, government debt will increase by nearly $42 billion, from $123 billion this year to $165 billion in 2026-27.

The province’s debt-to-revenue ratio is also set to soar from 95.1 per cent in 2023-24 to a staggering 151.2 per cent by 2026-27.

At the same time, population growth is far outpacing economic growth. Provincial population growth was around three per cent last year, far outpacing a modest 1.6 per cent growth in employment and a tiny 0.8 per cent rise in retail sales. Population growth outpacing employment is bad news for the economy, because that means there aren’t enough jobs being created to make sure B.C.’s newest residents can find work.

The province is also hiking taxes on fuel. The first provincial carbon tax is going up to 17 cents per litre, which will now add $11 to the cost filling up a small sedan. Only 24 per cent of British Columbians support a carbon tax, while about half somewhat or strongly oppose it. And a poll conducted last year by Innovative Research Group shows that only seven per cent of British Columbians want the carbon tax to keep rising.

If there is a silver lining to the burning dumpster fire of a budget presented by Conroy, it’s the increased Employer Health Tax threshold. The EHT threshold has been doubled from $500,000 to $1 million of payroll. That’s a good move which will save small businesses money.

The bottom line is that Eby and Conroy need to put down the taxpayer credit card, pick up a pair of scissors and restore some fiscal sanity to B.C.

Carson Binda is the British Columbia Director for the Canadian Taxpayers Federation