Ottawa's carbon tax dealt a huge blow in Alberta

Taxpayers have won a huge victory in Alberta as the province’s court of appeal found Ottawa’s heavy-handed carbon tax to be unconstitutional.

The court’s finding that the federal Greenhouse Gas Pollution Pricing Act tramples on provincial jurisdiction – going as far to describe it as a “Trojan horse” that “substantially overrides” several parts of the constitution – is a serious blow to Prime Minister Justin Trudeau’s government.

Alberta’s court decision follows similar challenges in Saskatchewan and Ontario that resulted in split-decisions upholding the carbon tax, confirming that there are strong legal arguments against the federal carbon tax.

It also marks the third time judges have flagged jurisdictional concerns. In Ontario, the dissenting judge made clear that he found the federal carbon tax to be an unconstitutional invasion of provincial powers, wondering whether it could open the door to Ottawa interfering in other inappropriate ways. In Saskatchewan, the two dissenting judges even labelled the Trudeau carbon tax “constitutionally repugnant.” Alberta’s court ruling builds on both of these positions and adds to the momentum taxpayers are taking into the Supreme Court case that is expected this March.

This is a significant shift on the legal front. When the carbon tax issue first started winding through the courts, carbon tax advocates were dismissive. But constitutional experts, such as University of Saskatchewan professor Dwight Newman, suggested the odds were closer than many expected. Close indeed. A total of 15 judges have now weighed in on the constitutionality of the federal carbon tax with eight ruling in favour and seven ruling against.

A new legal reality is now inescapably clear: it’s possible the Supreme Court could strike down the federal carbon tax.

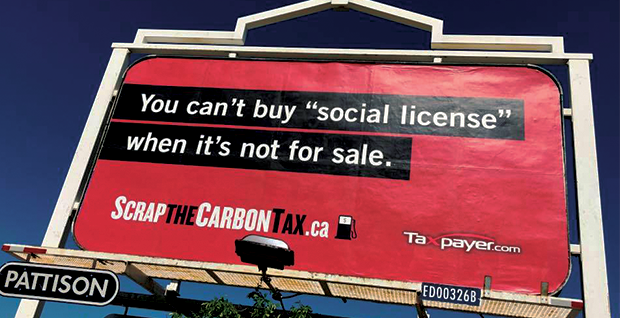

While the legal tide looks to be turning, the political current is also flowing against the carbon tax. Voters have opposed carbon taxes in provincial elections and even the federal election resulted in the government losing votes and seats. It’s easy to see why: Ottawa’s carbon tax has always been more about taxing Canadians rather than protecting the environment.

Canadians need look no further than British Columbia to see how a carbon tax has been successful at eating away taxpayers’ paycheques, but not much else. B.C. has the highest carbon tax in Canada, but, according to provincial analysis, the province’s emissions have risen five out of the last seven years.

The carbon tax is all economic pain without the environmental gain and politicians aren’t stopping global climate change by continuing to inflict harm on Canadian families and businesses.

Canada only produces 1.6 per cent of global greenhouse gas emissions so a carbon tax here won’t have a global impact – a point even Trudeau recognized when he said “even if Canada stopped everything tomorrow, and the other countries didn’t have any solutions, it wouldn't make a big difference.”

The federal government’s unpopular carbon tax is compounding its problems on other fronts where similarly unworkable policies are blocking resource development.

The cancellation of the Teck Resource’s $20-billion oil sands project is just the latest example. Regulatory and legal issues in Canada have already led to the cancellation of $100 billion worth of resource projects, according to the C.D. Howe Institute. Meanwhile Saudi Arabia is investing $110 billion to develop a natural gas field and Russia is moving forward with $150 billion investments touted as the “biggest project in the modern-day global oil industry.”

Bad policies cost Canadian taxpayers too much. Carbon taxes cost them too much when they pay for necessities such as filling up their minivans and heating their homes. Tangles of regulations that halt projects cost us jobs. The Alberta victory gives new hope that the Supreme Court will strike down the carbon tax and start making life a little easier for taxpayers.

Aaron Wudrick is the Federal Director and Franco Terrazzano is the Alberta Director of the Canadian Taxpayers Federation.

This column was originally published in the Toronto Sun on Feb. 28, 2020.